Thoughts on McDonald’s Acquiring Dynamic Yield

First thought.

“Would you like fries with that?”

Just kidding!

Retailers have been interested in acquisitions for a long time to help fill gaps in their customer segmentation, supply chain and yes, also in technology. Here are a few notable ones in the last couple of years, summarized:

| Retailer | Acquired Technology Vendor | Year | Est. $ Value | Area |

| McDonalds | Dynamic Yield | Mar 2019 | $300M | Personalization of Menus |

| Nordstrom | BevyUp

MessageYes |

Mar 2018 | Digital Sales

Conversational Commerce |

|

| Walmart | Spatialand | Feb 2018 | Virtual Reality (VR) | |

| Target | Shipt | Dec 2017 | $550M | Last Mile Delivery |

| Williams-Sonoma | Outward | Nov 2017 | $112M | Virtual Reality (VR) |

| Target | Grand Junction | Aug 2017 | Last Mile Delivery |

Note: All the eCommerce acquisitions have been deliberately omitted in this analysis, with a focus only on technology startups. The same with write-downs/spinoffs etc.

Tech acquisitions present a paradox. On the one hand, retailers need to invest in tech to stay even with, let alone get ahead of, the competition. On the other hand, tech acquisitions from Retailers can lead to proprietary technology infrastructures that end up hurting a company, a la Kmart. So what’s the right balance?

Let’s find out using a proxy – stock performance – the litmus test of the markets that applies to all publicly traded, shareholder-led companies.

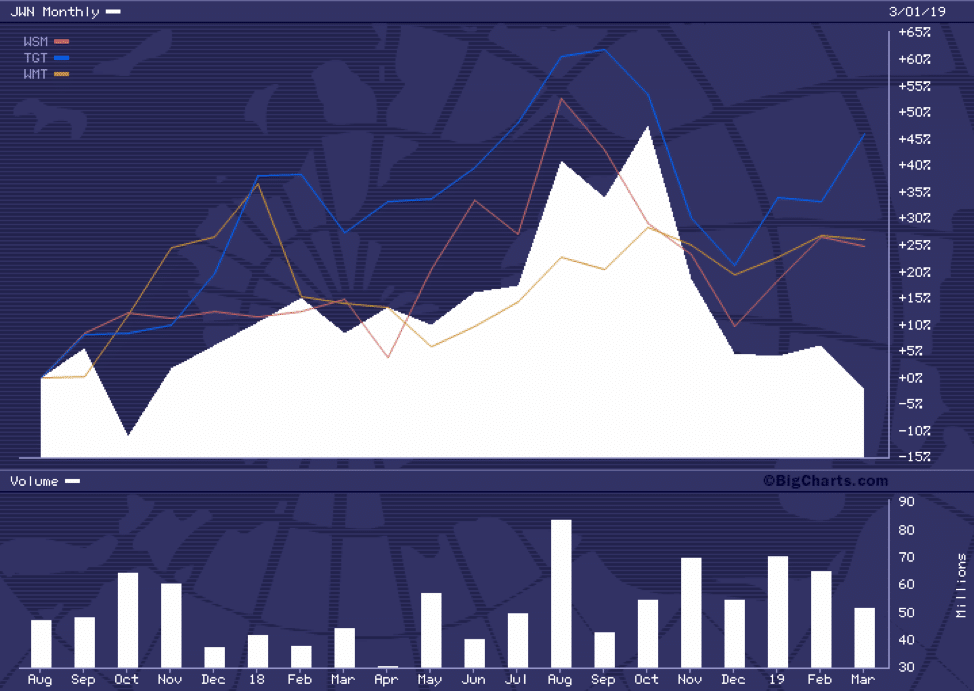

On a chart that compares Nordstrom as a baseline, against Williams-Sonoma, Target, and Walmart, we see the following for the time period from Aug 2017 to Mar 2019:

From Aug 2017 to Mar 2019

- Nordstrom has essentially stayed flat

- Williams-Sonoma by slightly less than ~25%

- Walmart by slightly more than ~25%

- Target by over 45%

Conclusion: Target is winning due to strategic acquisitions that are core to its business – last mile delivery – as everyone on this list battles Amazon.

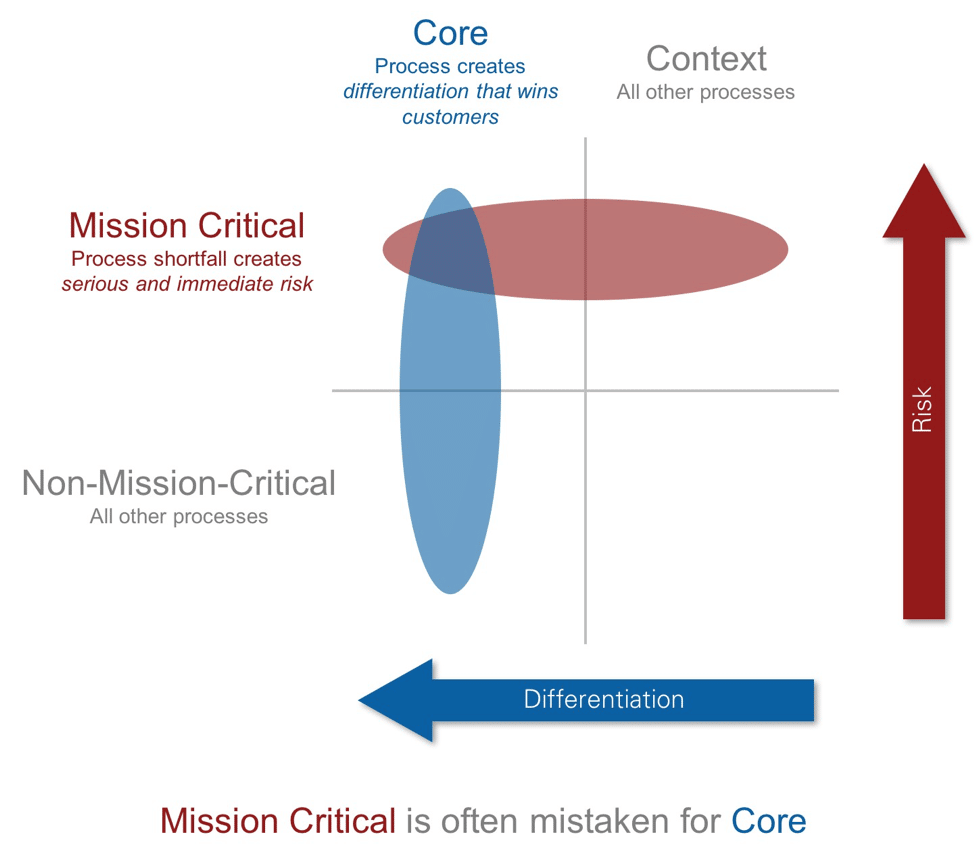

Many years ago, Geoffrey Moore introduced us to the idea of core v/s context. The concept was simple – anything that creates differentiation is core, but do NOT mistake core for mission-critical.

So, is technology mission-critical for Retailers? One can argue, yes, of course it is. How can you run a company without technology? But let’s pause for a second.

Turns out, there are two kinds of technology : buy-side and sell-side.

Sell-side technology is what is sold by software companies around the world. The folks that work on building it are engineering folks, and focus on creating a solution that matches the need of a broader market. Thanks to customer feedback and competition, innovation is faster (innovate or die) due to aligned incentives. And the company is intensely focused on winning new customers by focusing on its core – code that helps solve a real-world problem for a clearly defined ROI.

Buy-side technology is also known as IT. This group is common to all retailers and worries about procurement of technology from multiple sell-side software companies. IT is focused on all the elements to build the business support systems – and asking questions on security, performance, governance, integration and more – while keeping the lights on. This group is tuned towards being responsive to the internal business requirements, and reacting fast to deliver on internal needs. The competition is for resources and priority, and the ROI is internal and sometimes, allocations get political.

When Retailers buy sell-side technology, they become buy-side instantly.

In the absence of market-facing competition, the pressure to innovate is off, and the erstwhile sell-side company slowly declines into becoming a captive center. Engineers leave as they signed on for the original mission, not to become part of IT and learning how to navigate the labyrinthine paths of getting corporate approvals. Moreover, timelines mean something else as well, with a code shutdown in retail during peak seasons between Oct and Dec. Typically in a sell-side software company , this is the peak coding time – when you know that all of your customers are not interested in uptaking new code, the entire engineering teams can focus heads down on cranking out major releases.

So, what about McDonald’s buying Dynamic Yield? Three things:

- As stated here, the most immediate impact that we can expect is a modernization of their menus for drive-thrus for a better experience

- With over 37,000 stores worldwide, that’s a lot of menus to be personalized, keeping the DY team fully occupied as the new IT arm of innovation

- Immediate reconsideration from QSR clients who are competitive to McDonalds, as well as other verticals who clearly see this investment as not panning out in the long term

McDonald’s is an iconic brand, and this is a bold move for them. Will this work out for them? Only time will tell. But one thing is clear – Personalization is here to stay, and the checkbooks are coming out to prove it.